Technology

- DID

- Cryptography

- Smart contract

- Cross Chain

- TPS

Organization

Exchange

Digital assets

CBDC

Dapp

Network

Decentralized Identity: Passport to Web3

Introduction

The internet was created without a native identity layer for people. Because of this, the issue of digital identity was relegated to websites and applications. This siloed approach may have been appropriate for the early days of the internet, but with billions of people now online, its drawbacks are becoming more apparent. Usernames and passwords continue to be the dominant paradigm, despite being repeatedly demonstrated to be an insecure model. The average person has to juggle between 70 to 80 passwords, resulting in a decidedly inferior user experience. Indeed, there are multi-million dollar businesses built just around helping businesses and individuals manage their fragmented accounts, such as Okta, 1Password, and Dashlane. Most importantly, users do not actually own their online identity. Instead, they rent it from companies and centralized entities. Thus, they are prone to the risk of their digital identity being hacked, manipulated, censored, or simply lost.

The emergence of Web3, which fundamentally embeds economic transfers, has brought about a renewed emphasis on creating robust identity systems. Although decentralized identity (DID) has been a largely overlooked topic compared to DeFi, NFTs, and DAOs, we view it as a critical technological primitive that enables native Web3 applications. If we create a shared, flexible, and resilient identity layer, we can drastically unlock the pace of innovation by creating a wider design space.

In this report, we introduce key DID concepts and the current DID ecosystem on a high level and dive deeper into select projects that are at the forefront of building the identity foundation of Web3.

Decentralized Identity (DID)

The DID specification from the W3C is the widely-accepted standard, ensuring that identity systems can interoperate across different networks and platforms.

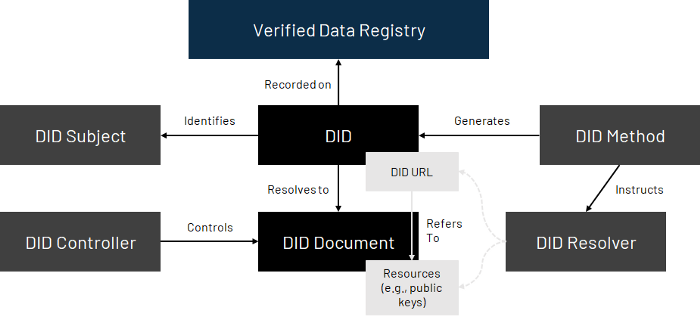

An overview of the DID architecture is illustrated below. A DID is an address on the internet that someone can own and control directly. It can be used to find connected DID documents, which contain information associated with the DID. DID documents contain relevant information to enable use cases, such as sign-in, data encryption, communication, etc. Cryptographic proofs, such as digital signatures, allow entities to prove control over these identifiers.

Basic Components of DID Architecture

In sum, the DID serves as the identity hub. Because users control their hub, they can decide when, with whom, and under what terms they reveal elements of their digital identity. And with greater adoption of the DID standard, individuals are not locked into a single ecosystem or siloed approach.

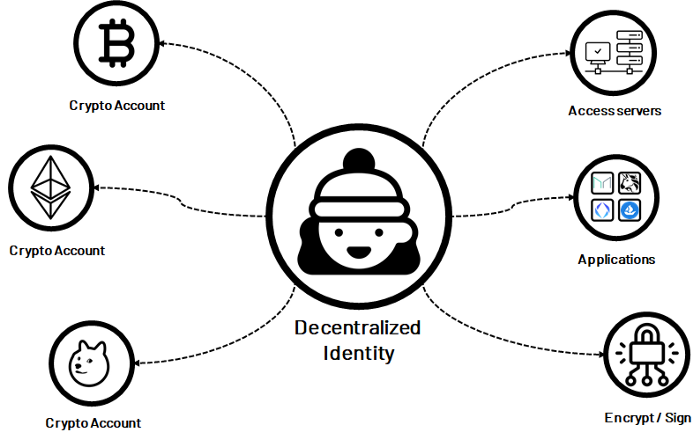

DIDs Provide Users with Control, Security, Privacy, and Portability

DIDs Enabling New Use Cases

In the physical world, identity is integral to a well-functioning society. Passports enable governments to identify their citizens, driver’s licenses allow citizens to claim rights to the road, university degrees confer qualifications, etc.

Similarly, DIDs will enable high-value internet economic activity. Below, we highlight some current Web3 pain points that DIDs could solve.

NFTs — Authenticity and Identity

Fraud and copyminting continue to plague artists and creators. For instance, Derek Laufman, a digital artist and designer of Marvel’s Super Hero Adventures, saw his works being auctioned off on NFT platform Rarible without his knowledge. Similar stories like this are common.

NFT Fraud Continues to Plague Artists

A strong DID infrastructure solves this. Applications can build off of DID to allow creators to provably sign off that an NFT, representing a digital or physical asset, was created by them. Buyers and sellers will be able to verify the provenance of the digital artwork too. DIDs could also help foster greater engagement between artists and their community, such as restricting NFT ownership to community members to limit speculation from scalpers or serving exclusive NFT content to select holders.

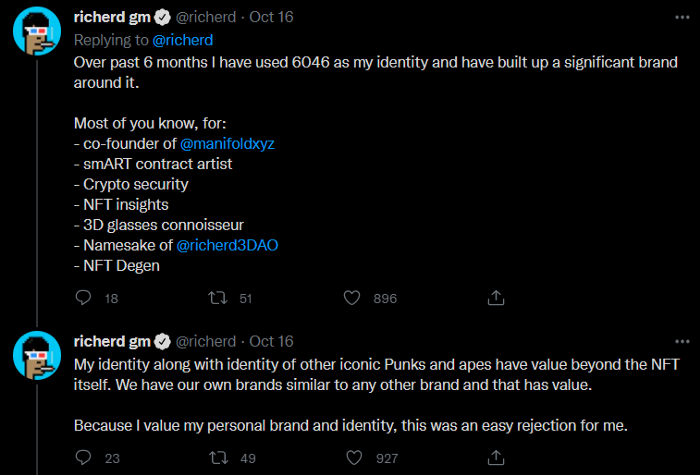

More broadly, NFTs could serve as one anchor for decentralized identity. Already, several users identify their online presence not merely with a username but also with an NFT project. As an example, co-founder of Manifold @richerd explained that he turned down a $9.5 million offer for his cryptopunk NFT because he identifies his cryptopunk as his identity and brand.

NFTs As Online Identities

Unlocking the Next Phase of DeFi

Collateralized loans have served as the backbone of DeFi growth so far. But because crypto finance protocols aim to be fully trustless and permissionless, they often required over-collateralization. For instance, loans taken out on ETH on MakerDAO require collateralization ratios of 130–170%. This has powered DeFi growth over the last year, but the collateral requirements restrict the use cases to mostly crypto traders looking to take on leverage. For most people, the reason they want to borrow is that they do not already have the money that they need.

Lowering or completely removing the collateral requirement is key to introducing DeFi to mass adoption. Having a strong DID layer could allow for “on-chain” credit scores, providing users access to credit-based lending. Furthermore, because users directly control their credit score, they can better monitor and adjust their borrowing/lending behavior. Thus, DID offers the chance of further democratizing decentralized financial systems.

In addition, having a strong identity layer to financial applications could solve other current problems in DeFi, such as:

- Improving fair distribution of token airdrops by authenticating actual members and reducing the potential for bots to dilute airdrop events.

- Using DIDs to gate access to DeFi pools to reduce spam/sybil attacks or enable institutions to participate by providing compliance tools to identify counterparties.

- Guiding users through the dark forest of Ethereum by illuminating participants that can be trusted act in positive-sum ways.

Decentralized Autonomous Organizations (DAOs)

DAOs often use token-based governance for voting, influence, and priorities. This generally makes sense — large tokenholders have the most skin-in-the-game — but it can exclude or deprioritize active contributors who may not have large amounts of capital. And although members can build their reputation within a DAO, they may need to build credibility from scratch in a new context.

DIDs could preserve a user’s reputation across multiple DAOs. Porting over credentials from one DAO to another reflects the reputation portability that we already enjoy in the physical world, preventing active contributors from having to start from zero. Furthermore, other Web3 contexts, such as participation in Gitcoin, publications to Mirror, or code contribution to Radicle, could further help DAOs find qualified candidates.

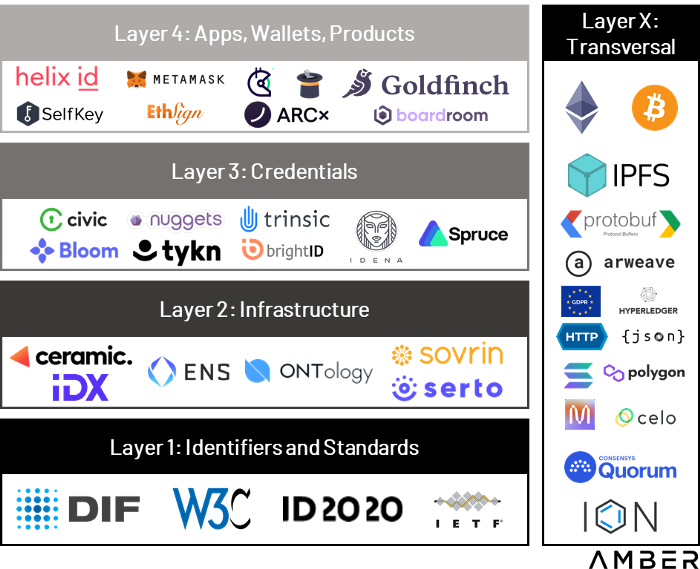

The DID Ecosystem

The DID ecosystem can be broken down into layers, in which each layer on the top builds upon the underlying protocol. We leverage and slightly modify DIF’s 4-Layer Identity Model to map current DID projects by their primary focus, with the caveat that this is a simplifying model and most projects transcend one layer.

The Decentralized Identity Ecosystem by Layers

Layer 1: Identifiers and Standards

Standards, identifiers, and namespaces create the public trust layer, ensuring standardization, portability, and interoperability. They also allow networks to register and govern DID methods, providing developers and users with the rules and context of the network’s ID system.

The Decentralized Identity Foundation (DIF) is the key player of this layer and the cornerstone of the ecosystem. It acts as the center for development, discussion, and management of all activities required to create and maintain an interoperable & open ecosystem for the DID stack.

Layer 2: Infrastructure

Infrastructure and agent frameworks allow applications to interact directly with each other and verifiable data registries. These solutions include communication, storage, and key management. We highlight Ceramic and ENS as projects at the front line of building DID infrastructure (although ENS’ categorization can be debated, we place it at the infrastructure layer as we foresee credentials and applications will be built on top of ENS in the future).

Layer 3 : Credentials

Credentials have to be managed, updated, and exchanged. This layer aims to address how DIDs can negotiate proof of control and authentication, as well as securely passing data between identity owners.

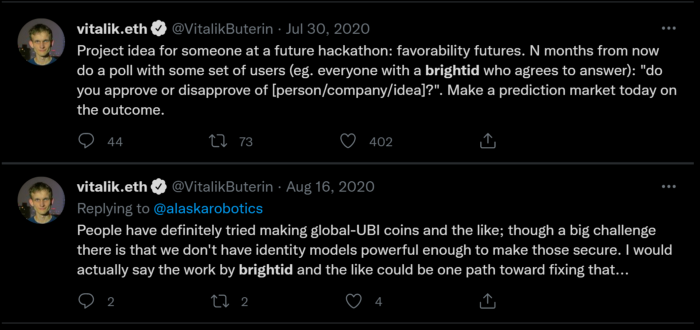

BrightID is a notable project in this area. It is a social identity network with over 30,000 users that allows people to prove to applications that they aren’t using multiple accounts, thus minimizing the chances of sybil attacks.

Vitalik Buterin on BrightID’s Potential Applications

Layer 4: Apps, Wallets, and Products

This layer is likely most familiar to readers and intends to provide real-world use cases and value to consumers. Some projects, such as Goldfinch (uncollateralized lending), use proprietary unique entity checks but aim to leverage decentralized ID solutions when they mature. In contrast, other applications already leverage existing DID technologies, such as TrueFi (uncollateralized lending with on-chain credit scores), Gitcoin (funding of public goods), and Ethsign (decentralized electronic agreements).

Layer X: Transversal

These projects largely transcend any individual layer and have consequences at multiple levels. For instance, Europe’s GDPR data protection law has ramifications across all areas of the ecosystem.

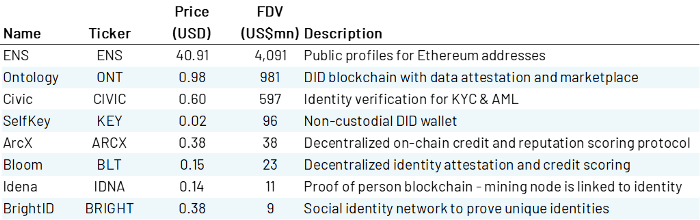

Token Valuations in the DID Ecosystem

References

Decentralized Identity: Passport to Web3,Amber Group,Nov 23, 2021Cryptography

Cryptography, or cryptology (from Ancient Greek: κρυπτός, romanized: kryptós "hidden, secret"; and γράφειν graphein, "to write", or -λογία -logia, "study", respectively), is the practice and study of techniques for secure communication in the presence of adversarial behavior. More generally, cryptography is about constructing and analyzing protocols that prevent third parties or the public from reading private messages; various aspects in information security such as data confidentiality, data integrity, authentication, and non-repudiation are central to modern cryptography. Modern cryptography exists at the intersection of the disciplines of mathematics, computer science, electrical engineering, communication science, and physics. Applications of cryptography include electronic commerce, chip-based payment cards, digital currencies, computer passwords, and military communications.

Cryptography prior to the modern age was effectively synonymous with encryption, converting information from a readable state to unintelligible nonsense. The sender of an encrypted message shares the decoding technique only with intended recipients to preclude access from adversaries. The cryptography literature often uses the names Alice ("A") for the sender, Bob ("B") for the intended recipient, and Eve ("eavesdropper") for the adversary. Since the development of rotor cipher machines in World War I and the advent of computers in World War II, cryptography methods have become increasingly complex and its applications more varied.

Modern cryptography is heavily based on mathematical theory and computer science practice; cryptographic algorithms are designed around computational hardness assumptions, making such algorithms hard to break in actual practice by any adversary. While it is theoretically possible to break into a well-designed system, it is infeasible in actual practice to do so. Such schemes, if well designed, are therefore termed "computationally secure"; theoretical advances (e.g., improvements in integer factorization algorithms) and faster computing technology require these designs to be continually reevaluated, and if necessary, adapted. Information-theoretically secure schemes that provably cannot be broken even with unlimited computing power, such as the one-time pad, are much more difficult to use in practice than the best theoretically breakable, but computationally secure, schemes.

The growth of cryptographic technology has raised a number of legal issues in the Information Age. Cryptography's potential for use as a tool for espionage and sedition has led many governments to classify it as a weapon and to limit or even prohibit its use and export. In some jurisdictions where the use of cryptography is legal, laws permit investigators to compel the disclosure of encryption keys for documents relevant to an investigation. Cryptography also plays a major role in digital rights management and copyright infringement disputes in regard to digital media.

Terminology

The first use of the term "cryptograph" (as opposed to "cryptogram") dates back to the 19th century—originating from "The Gold-Bug," a story by Edgar Allan Poe.

Until modern times, cryptography referred almost exclusively to "encryption", which is the process of converting ordinary information (called plaintext) into unintelligible form (called ciphertext). Decryption is the reverse, in other words, moving from the unintelligible ciphertext back to plaintext. A cipher (or cypher) is a pair of algorithms that carry out the encryption and the reversing decryption. The detailed operation of a cipher is controlled both by the algorithm and, in each instance, by a "key". The key is a secret (ideally known only to the communicants), usually a string of characters (ideally short so it can be remembered by the user), which is needed to decrypt the ciphertext. In formal mathematical terms, a "cryptosystem" is the ordered list of elements of finite possible plaintexts, finite possible cyphertexts, finite possible keys, and the encryption and decryption algorithms which correspond to each key. Keys are important both formally and in actual practice, as ciphers without variable keys can be trivially broken with only the knowledge of the cipher used and are therefore useless (or even counter-productive) for most purposes. Historically, ciphers were often used directly for encryption or decryption without additional procedures such as authentication or integrity checks.

There are two main types of cryptosystems: symmetric and asymmetric. In symmetric systems, the only ones known until the 1970s, the same secret key encrypts and decrypts a message. Data manipulation in symmetric systems is significantly faster than in asymetric systems. Asymmetric systems use a "public key" to encrypt a message and a related "private key" to decrypt it. The advantage of asymmetric systems is that the public key can be freely published, allowing parties to establish secure communication without having a shared secret key. In practice, asymmetric systems are used to first exchange a secret key, and then secure communication proceeds via a more efficient symmetric system using that key. Examples of asymmetric systems include Diffie–Hellman key exchange, RSA (Rivest–Shamir–Adleman), ECC (Elliptic Curve Cryptography), and Post-quantum cryptography. Secure symmetric algorithms include the commonly used AES (Advanced Encryption Standard) which replaced the older DES (Data Encryption Standard). Insecure symmetric algorithms include children's language tangling schemes such as Pig Latin or other cant, and all historical cryptographic schemes, however seriously intended, prior to the invention of the one-time pad early in the 20th century.

In colloquial use, the term "code" is often used to mean any method of encryption or concealment of meaning. However, in cryptography, code has a more specific meaning: the replacement of a unit of plaintext (i.e., a meaningful word or phrase) with a code word (for example, "wallaby" replaces "attack at dawn"). A cypher, in contrast, is a scheme for changing or substituting an element below such a level (a letter, or a syllable or a pair of letters, etc.) in order to produce a cyphertext.

Cryptanalysis is the term used for the study of methods for obtaining the meaning of encrypted information without access to the key normally required to do so; i.e., it is the study of how to "crack" encryption algorithms or their implementations.

Some use the terms "cryptography" and "cryptology" interchangeably in English, while others (including US military practice generally) use "cryptography" to refer specifically to the use and practice of cryptographic techniques and "cryptology" to refer to the combined study of cryptography and cryptanalysis. English is more flexible than several other languages in which "cryptology" (done by cryptologists) is always used in the second sense above. RFC 2828 advises that steganography is sometimes included in cryptology.

The study of characteristics of languages that have some application in cryptography or cryptology (e.g. frequency data, letter combinations, universal patterns, etc.) is called cryptolinguistics.

History of cryptography and cryptanalysis

Before the modern era, cryptography focused on message confidentiality (i.e., encryption)—conversion of messages from a comprehensible form into an incomprehensible one and back again at the other end, rendering it unreadable by interceptors or eavesdroppers without secret knowledge (namely the key needed for decryption of that message). Encryption attempted to ensure secrecy in communications, such as those of spies, military leaders, and diplomats. In recent decades, the field has expanded beyond confidentiality concerns to include techniques for message integrity checking, sender/receiver identity authentication, digital signatures, interactive proofs and secure computation, among others.

Classic cryptography

The main classical cipher types are transposition ciphers, which rearrange the order of letters in a message (e.g., 'hello world' becomes 'ehlol owrdl' in a trivially simple rearrangement scheme), and substitution ciphers, which systematically replace letters or groups of letters with other letters or groups of letters (e.g., 'fly at once' becomes 'gmz bu podf' by replacing each letter with the one following it in the Latin alphabet). Simple versions of either have never offered much confidentiality from enterprising opponents. An early substitution cipher was the Caesar cipher, in which each letter in the plaintext was replaced by a letter some fixed number of positions further down the alphabet. Suetonius reports that Julius Caesar used it with a shift of three to communicate with his generals. Atbash is an example of an early Hebrew cipher. The earliest known use of cryptography is some carved ciphertext on stone in Egypt (ca 1900 BCE), but this may have been done for the amusement of literate observers rather than as a way of concealing information.

The Greeks of Classical times are said to have known of ciphers (e.g., the scytale transposition cipher claimed to have been used by the Spartan military). Steganography (i.e., hiding even the existence of a message so as to keep it confidential) was also first developed in ancient times. An early example, from Herodotus, was a message tattooed on a slave's shaved head and concealed under the regrown hair. More modern examples of steganography include the use of invisible ink, microdots, and digital watermarks to conceal information.

In India, the 2000-year-old Kamasutra of Vātsyāyana speaks of two different kinds of ciphers called Kautiliyam and Mulavediya. In the Kautiliyam, the cipher letter substitutions are based on phonetic relations, such as vowels becoming consonants. In the Mulavediya, the cipher alphabet consists of pairing letters and using the reciprocal ones.

In Sassanid Persia, there were two secret scripts, according to the Muslim author Ibn al-Nadim: the šāh-dabīrīya (literally "King's script") which was used for official correspondence, and the rāz-saharīya which was used to communicate secret messages with other countries.

David Kahn notes in The Codebreakers that modern cryptology originated among the Arabs, the first people to systematically document cryptanalytic methods. Al-Khalil (717–786) wrote the Book of Cryptographic Messages, which contains the first use of permutations and combinations to list all possible Arabic words with and without vowels.

Ciphertexts produced by a classical cipher (and some modern ciphers) will reveal statistical information about the plaintext, and that information can often be used to break the cipher. After the discovery of frequency analysis, perhaps by the Arab mathematician and polymath Al-Kindi (also known as Alkindus) in the 9th century, nearly all such ciphers could be broken by an informed attacker. Such classical ciphers still enjoy popularity today, though mostly as puzzles (see cryptogram). Al-Kindi wrote a book on cryptography entitled Risalah fi Istikhraj al-Mu'amma (Manuscript for the Deciphering Cryptographic Messages), which described the first known use of frequency analysis cryptanalysis techniques.

Language letter frequencies may offer little help for some extended historical encryption techniques such as homophonic cipher that tend to flatten the frequency distribution. For those ciphers, language letter group (or n-gram) frequencies may provide an attack.

Essentially all ciphers remained vulnerable to cryptanalysis using the frequency analysis technique until the development of the polyalphabetic cipher, most clearly by Leon Battista Alberti around the year 1467, though there is some indication that it was already known to Al-Kindi. Alberti's innovation was to use different ciphers (i.e., substitution alphabets) for various parts of a message (perhaps for each successive plaintext letter at the limit). He also invented what was probably the first automatic cipher device, a wheel which implemented a partial realization of his invention. In the Vigenère cipher, a polyalphabetic cipher, encryption uses a key word, which controls letter substitution depending on which letter of the key word is used. In the mid-19th century Charles Babbage showed that the Vigenère cipher was vulnerable to Kasiski examination, but this was first published about ten years later by Friedrich Kasiski.

Although frequency analysis can be a powerful and general technique against many ciphers, encryption has still often been effective in practice, as many a would-be cryptanalyst was unaware of the technique. Breaking a message without using frequency analysis essentially required knowledge of the cipher used and perhaps of the key involved, thus making espionage, bribery, burglary, defection, etc., more attractive approaches to the cryptanalytically uninformed. It was finally explicitly recognized in the 19th century that secrecy of a cipher's algorithm is not a sensible nor practical safeguard of message security; in fact, it was further realized that any adequate cryptographic scheme (including ciphers) should remain secure even if the adversary fully understands the cipher algorithm itself. Security of the key used should alone be sufficient for a good cipher to maintain confidentiality under an attack. This fundamental principle was first explicitly stated in 1883 by Auguste Kerckhoffs and is generally called Kerckhoffs's Principle; alternatively and more bluntly, it was restated by Claude Shannon, the inventor of information theory and the fundamentals of theoretical cryptography, as Shannon's Maxim—'the enemy knows the system'.

Different physical devices and aids have been used to assist with ciphers. One of the earliest may have been the scytale of ancient Greece, a rod supposedly used by the Spartans as an aid for a transposition cipher. In medieval times, other aids were invented such as the cipher grille, which was also used for a kind of steganography. With the invention of polyalphabetic ciphers came more sophisticated aids such as Alberti's own cipher disk, Johannes Trithemius' tabula recta scheme, and Thomas Jefferson's wheel cypher (not publicly known, and reinvented independently by Bazeries around 1900). Many mechanical encryption/decryption devices were invented early in the 20th century, and several patented, among them rotor machines—famously including the Enigma machine used by the German government and military from the late 1920s and during World War II. The ciphers implemented by better quality examples of these machine designs brought about a substantial increase in cryptanalytic difficulty after WWI.

Computer era

Prior to the early 20th century, cryptography was mainly concerned with linguistic and lexicographic patterns. Since then the emphasis has shifted, and cryptography now makes extensive use of mathematics, including aspects of information theory, computational complexity, statistics, combinatorics, abstract algebra, number theory, and finite mathematics generally. Cryptography is also a branch of engineering, but an unusual one since it deals with active, intelligent, and malevolent opposition; other kinds of engineering (e.g., civil or chemical engineering) need deal only with neutral natural forces. There is also active research examining the relationship between cryptographic problems and quantum physics.

Just as the development of digital computers and electronics helped in cryptanalysis, it made possible much more complex ciphers. Furthermore, computers allowed for the encryption of any kind of data representable in any binary format, unlike classical ciphers which only encrypted written language texts; this was new and significant. Computer use has thus supplanted linguistic cryptography, both for cipher design and cryptanalysis. Many computer ciphers can be characterized by their operation on binary bit sequences (sometimes in groups or blocks), unlike classical and mechanical schemes, which generally manipulate traditional characters (i.e., letters and digits) directly. However, computers have also assisted cryptanalysis, which has compensated to some extent for increased cipher complexity. Nonetheless, good modern ciphers have stayed ahead of cryptanalysis; it is typically the case that use of a quality cipher is very efficient (i.e., fast and requiring few resources, such as memory or CPU capability), while breaking it requires an effort many orders of magnitude larger, and vastly larger than that required for any classical cipher, making cryptanalysis so inefficient and impractical as to be effectively impossible.

Advent of modern cryptography

Cryptanalysis of the new mechanical devices proved to be both difficult and laborious. In the United Kingdom, cryptanalytic efforts at Bletchley Park during WWII spurred the development of more efficient means for carrying out repetitious tasks. This culminated in the development of the Colossus, the world's first fully electronic, digital, programmable computer, which assisted in the decryption of ciphers generated by the German Army's Lorenz SZ40/42 machine.

Extensive open academic research into cryptography is relatively recent; it began only in the mid-1970s. In recent times, IBM personnel designed the algorithm that became the Federal (i.e., US) Data Encryption Standard; Whitfield Diffie and Martin Hellman published their key agreement algorithm;[27] and the RSA algorithm was published in Martin Gardner's Scientific American column. Since then, cryptography has become a widely used tool in communications, computer networks, and computer security generally.

Some modern cryptographic techniques can only keep their keys secret if certain mathematical problems are intractable, such as the integer factorization or the discrete logarithm problems, so there are deep connections with abstract mathematics. There are very few cryptosystems that are proven to be unconditionally secure. The one-time pad is one, and was proven to be so by Claude Shannon. There are a few important algorithms that have been proven secure under certain assumptions. For example, the infeasibility of factoring extremely large integers is the basis for believing that RSA is secure, and some other systems, but even so, proof of unbreakability is unavailable since the underlying mathematical problem remains open. In practice, these are widely used, and are believed unbreakable in practice by most competent observers. There are systems similar to RSA, such as one by Michael O. Rabin that are provably secure provided factoring n = pq is impossible; it is quite unusable in practice. The discrete logarithm problem is the basis for believing some other cryptosystems are secure, and again, there are related, less practical systems that are provably secure relative to the solvability or insolvability discrete log problem.

As well as being aware of cryptographic history, cryptographic algorithm and system designers must also sensibly consider probable future developments while working on their designs. For instance, continuous improvements in computer processing power have increased the scope of brute-force attacks, so when specifying key lengths, the required key lengths are similarly advancing.[29] The potential effects of quantum computing are already being considered by some cryptographic system designers developing post-quantum cryptography; the announced imminence of small implementations of these machines may be making the need for preemptive caution rather more than merely speculative.

Modern cryptography

Symmetric-key cryptography

Symmetric-key cryptography refers to encryption methods in which both the sender and receiver share the same key (or, less commonly, in which their keys are different, but related in an easily computable way). This was the only kind of encryption publicly known until June 1976.

Symmetric key ciphers are implemented as either block ciphers or stream ciphers. A block cipher enciphers input in blocks of plaintext as opposed to individual characters, the input form used by a stream cipher.

The Data Encryption Standard (DES) and the Advanced Encryption Standard (AES) are block cipher designs that have been designated cryptography standards by the US government (though DES's designation was finally withdrawn after the AES was adopted).[30] Despite its deprecation as an official standard, DES (especially its still-approved and much more secure triple-DES variant) remains quite popular; it is used across a wide range of applications, from ATM encryption[31] to e-mail privacy[32] and secure remote access.[33] Many other block ciphers have been designed and released, with considerable variation in quality. Many, even some designed by capable practitioners, have been thoroughly broken, such as FEAL.

Stream ciphers, in contrast to the 'block' type, create an arbitrarily long stream of key material, which is combined with the plaintext bit-by-bit or character-by-character, somewhat like the one-time pad. In a stream cipher, the output stream is created based on a hidden internal state that changes as the cipher operates. That internal state is initially set up using the secret key material. RC4 is a widely used stream cipher.[4] Block ciphers can be used as stream ciphers by generating blocks of a keystream (in place of a Pseudorandom number generator) and applying an XOR operation to each bit of the plaintext with each bit of the keystream.

Message authentication codes (MACs) are much like cryptographic hash functions, except that a secret key can be used to authenticate the hash value upon receipt;[4] this additional complication blocks an attack scheme against bare digest algorithms, and so has been thought worth the effort. Cryptographic hash functions are a third type of cryptographic algorithm. They take a message of any length as input, and output a short, fixed-length hash, which can be used in (for example) a digital signature. For good hash functions, an attacker cannot find two messages that produce the same hash. MD4 is a long-used hash function that is now broken; MD5, a strengthened variant of MD4, is also widely used but broken in practice. The US National Security Agency developed the Secure Hash Algorithm series of MD5-like hash functions: SHA-0 was a flawed algorithm that the agency withdrew; SHA-1 is widely deployed and more secure than MD5, but cryptanalysts have identified attacks against it; the SHA-2 family improves on SHA-1, but is vulnerable to clashes as of 2011; and the US standards authority thought it "prudent" from a security perspective to develop a new standard to "significantly improve the robustness of NIST's overall hash algorithm toolkit."[36] Thus, a hash function design competition was meant to select a new U.S. national standard, to be called SHA-3, by 2012. The competition ended on October 2, 2012, when the NIST announced that Keccak would be the new SHA-3 hash algorithm.[37] Unlike block and stream ciphers that are invertible, cryptographic hash functions produce a hashed output that cannot be used to retrieve the original input data. Cryptographic hash functions are used to verify the authenticity of data retrieved from an untrusted source or to add a layer of security.

Public-key cryptography

Symmetric-key cryptosystems use the same key for encryption and decryption of a message, although a message or group of messages can have a different key than others. A significant disadvantage of symmetric ciphers is the key management necessary to use them securely. Each distinct pair of communicating parties must, ideally, share a different key, and perhaps for each ciphertext exchanged as well. The number of keys required increases as the square of the number of network members, which very quickly requires complex key management schemes to keep them all consistent and secret.

In a groundbreaking 1976 paper, Whitfield Diffie and Martin Hellman proposed the notion of public-key (also, more generally, called asymmetric key) cryptography in which two different but mathematically related keys are used—a public key and a private key.[38] A public key system is so constructed that calculation of one key (the 'private key') is computationally infeasible from the other (the 'public key'), even though they are necessarily related. Instead, both keys are generated secretly, as an interrelated pair.[39] The historian David Kahn described public-key cryptography as "the most revolutionary new concept in the field since polyalphabetic substitution emerged in the Renaissance".

In public-key cryptosystems, the public key may be freely distributed, while its paired private key must remain secret. In a public-key encryption system, the public key is used for encryption, while the private or secret key is used for decryption. While Diffie and Hellman could not find such a system, they showed that public-key cryptography was indeed possible by presenting the Diffie–Hellman key exchange protocol, a solution that is now widely used in secure communications to allow two parties to secretly agree on a shared encryption key.[27] The X.509 standard defines the most commonly used format for public key certificates.

Diffie and Hellman's publication sparked widespread academic efforts in finding a practical public-key encryption system. This race was finally won in 1978 by Ronald Rivest, Adi Shamir, and Len Adleman, whose solution has since become known as the RSA algorithm.

The Diffie–Hellman and RSA algorithms, in addition to being the first publicly known examples of high-quality public-key algorithms, have been among the most widely used. Other asymmetric-key algorithms include the Cramer–Shoup cryptosystem, ElGamal encryption, and various elliptic curve techniques.

A document published in 1997 by the Government Communications Headquarters (GCHQ), a British intelligence organization, revealed that cryptographers at GCHQ had anticipated several academic developments.[43] Reportedly, around 1970, James H. Ellis had conceived the principles of asymmetric key cryptography. In 1973, Clifford Cocks invented a solution that was very similar in design rationale to RSA.[43][44] In 1974, Malcolm J. Williamson is claimed to have developed the Diffie–Hellman key exchange.

ublic-key cryptography is also used for implementing digital signature schemes. A digital signature is reminiscent of an ordinary signature; they both have the characteristic of being easy for a user to produce, but difficult for anyone else to forge. Digital signatures can also be permanently tied to the content of the message being signed; they cannot then be 'moved' from one document to another, for any attempt will be detectable. In digital signature schemes, there are two algorithms: one for signing, in which a secret key is used to process the message (or a hash of the message, or both), and one for verification, in which the matching public key is used with the message to check the validity of the signature. RSA and DSA are two of the most popular digital signature schemes. Digital signatures are central to the operation of public key infrastructures and many network security schemes (e.g., SSL/TLS, many VPNs, etc.).[34]

Public-key algorithms are most often based on the computational complexity of "hard" problems, often from number theory. For example, the hardness of RSA is related to the integer factorization problem, while Diffie–Hellman and DSA are related to the discrete logarithm problem. The security of elliptic curve cryptography is based on number theoretic problems involving elliptic curves. Because of the difficulty of the underlying problems, most public-key algorithms involve operations such as modular multiplication and exponentiation, which are much more computationally expensive than the techniques used in most block ciphers, especially with typical key sizes. As a result, public-key cryptosystems are commonly hybrid cryptosystems, in which a fast high-quality symmetric-key encryption algorithm is used for the message itself, while the relevant symmetric key is sent with the message, but encrypted using a public-key algorithm. Similarly, hybrid signature schemes are often used, in which a cryptographic hash function is computed, and only the resulting hash is digitally signed.[4]

Cryptographic Hash Functions

Cryptographic Hash Functions are cryptographic algorithms that are ways to generate and utilize specific keys to encrypt data for either symmetric or asymmetric encryption, and such functions may be viewed as keys themselves. They take a message of any length as input, and output a short, fixed-length hash, which can be used in (for example) a digital signature. For good hash functions, an attacker cannot find two messages that produce the same hash. MD4 is a long-used hash function that is now broken; MD5, a strengthened variant of MD4, is also widely used but broken in practice. The US National Security Agency developed the Secure Hash Algorithm series of MD5-like hash functions: SHA-0 was a flawed algorithm that the agency withdrew; SHA-1 is widely deployed and more secure than MD5, but cryptanalysts have identified attacks against it; the SHA-2 family improves on SHA-1, but is vulnerable to clashes as of 2011; and the US standards authority thought it "prudent" from a security perspective to develop a new standard to "significantly improve the robustness of NIST's overall hash algorithm toolkit."[36] Thus, a hash function design competition was meant to select a new U.S. national standard, to be called SHA-3, by 2012. The competition ended on October 2, 2012, when the NIST announced that Keccak would be the new SHA-3 hash algorithm.[37] Unlike block and stream ciphers that are invertible, cryptographic hash functions produce a hashed output that cannot be used to retrieve the original input data. Cryptographic hash functions are used to verify the authenticity of data retrieved from an untrusted source or to add a layer of security.

Cryptanalysis

The goal of cryptanalysis is to find some weakness or insecurity in a cryptographic scheme, thus permitting its subversion or evasion.

It is a common misconception that every encryption method can be broken. In connection with his WWII work at Bell Labs, Claude Shannon proved that the one-time pad cipher is unbreakable, provided the key material is truly random, never reused, kept secret from all possible attackers, and of equal or greater length than the message.[46] Most ciphers, apart from the one-time pad, can be broken with enough computational effort by brute force attack, but the amount of effort needed may be exponentially dependent on the key size, as compared to the effort needed to make use of the cipher. In such cases, effective security could be achieved if it is proven that the effort required (i.e., "work factor", in Shannon's terms) is beyond the ability of any adversary. This means it must be shown that no efficient method (as opposed to the time-consuming brute force method) can be found to break the cipher. Since no such proof has been found to date, the one-time-pad remains the only theoretically unbreakable cipher. Although well-implemented one-time-pad encryption cannot be broken, traffic analysis is still possible.

There are a wide variety of cryptanalytic attacks, and they can be classified in any of several ways. A common distinction turns on what Eve (an attacker) knows and what capabilities are available. In a ciphertext-only attack, Eve has access only to the ciphertext (good modern cryptosystems are usually effectively immune to ciphertext-only attacks). In a known-plaintext attack, Eve has access to a ciphertext and its corresponding plaintext (or to many such pairs). In a chosen-plaintext attack, Eve may choose a plaintext and learn its corresponding ciphertext (perhaps many times); an example is gardening, used by the British during WWII. In a chosen-ciphertext attack, Eve may be able to choose ciphertexts and learn their corresponding plaintexts.[4] Finally in a man-in-the-middle attack Eve gets in between Alice (the sender) and Bob (the recipient), accesses and modifies the traffic and then forwards it to the recipient.[47] Also important, often overwhelmingly so, are mistakes (generally in the design or use of one of the protocols involved).

Cryptanalysis of symmetric-key ciphers typically involves looking for attacks against the block ciphers or stream ciphers that are more efficient than any attack that could be against a perfect cipher. For example, a simple brute force attack against DES requires one known plaintext and 255 decryptions, trying approximately half of the possible keys, to reach a point at which chances are better than even that the key sought will have been found. But this may not be enough assurance; a linear cryptanalysis attack against DES requires 243 known plaintexts (with their corresponding ciphertexts) and approximately 243 DES operations.[48] This is a considerable improvement over brute force attacks.

Public-key algorithms are based on the computational difficulty of various problems. The most famous of these are the difficulty of integer factorization of semiprimes and the difficulty of calculating discrete logarithms, both of which are not yet proven to be solvable in polynomial time (P) using only a classical Turing-complete computer. Much public-key cryptanalysis concerns designing algorithms in P that can solve these problems, or using other technologies, such as quantum computers. For instance, the best-known algorithms for solving the elliptic curve-based version of discrete logarithm are much more time-consuming than the best-known algorithms for factoring, at least for problems of more or less equivalent size. Thus, to achieve an equivalent strength of encryption, techniques that depend upon the difficulty of factoring large composite numbers, such as the RSA cryptosystem, require larger keys than elliptic curve techniques. For this reason, public-key cryptosystems based on elliptic curves have become popular since their invention in the mid-1990s.

While pure cryptanalysis uses weaknesses in the algorithms themselves, other attacks on cryptosystems are based on actual use of the algorithms in real devices, and are called side-channel attacks. If a cryptanalyst has access to, for example, the amount of time the device took to encrypt a number of plaintexts or report an error in a password or PIN character, he may be able to use a timing attack to break a cipher that is otherwise resistant to analysis. An attacker might also study the pattern and length of messages to derive valuable information; this is known as traffic analysis[49] and can be quite useful to an alert adversary. Poor administration of a cryptosystem, such as permitting too short keys, will make any system vulnerable, regardless of other virtues. Social engineering and other attacks against humans (e.g., bribery, extortion, blackmail, espionage, torture, ...) are usually employed due to being more cost-effective and feasible to perform in a reasonable amount of time compared to pure cryptanalysis by a high margin.

Cryptographic primitives

Much of the theoretical work in cryptography concerns cryptographic primitives—algorithms with basic cryptographic properties—and their relationship to other cryptographic problems. More complicated cryptographic tools are then built from these basic primitives. These primitives provide fundamental properties, which are used to develop more complex tools called cryptosystems or cryptographic protocols, which guarantee one or more high-level security properties. Note, however, that the distinction between cryptographic primitives and cryptosystems, is quite arbitrary; for example, the RSA algorithm is sometimes considered a cryptosystem, and sometimes a primitive. Typical examples of cryptographic primitives include pseudorandom functions, one-way functions, etc.

Cryptosystems

One or more cryptographic primitives are often used to develop a more complex algorithm, called a cryptographic system, or cryptosystem. Cryptosystems (e.g., El-Gamal encryption) are designed to provide particular functionality (e.g., public key encryption) while guaranteeing certain security properties (e.g., chosen-plaintext attack (CPA) security in the random oracle model). Cryptosystems use the properties of the underlying cryptographic primitives to support the system's security properties. As the distinction between primitives and cryptosystems is somewhat arbitrary, a sophisticated cryptosystem can be derived from a combination of several more primitive cryptosystems. In many cases, the cryptosystem's structure involves back and forth communication among two or more parties in space (e.g., between the sender of a secure message and its receiver) or across time (e.g., cryptographically protected backup data). Such cryptosystems are sometimes called cryptographic protocols.

Some widely known cryptosystems include RSA, Schnorr signature, ElGamal encryption, and Pretty Good Privacy (PGP). More complex cryptosystems include electronic cash[50] systems, signcryption systems, etc. Some more 'theoretical'[clarification needed] cryptosystems include interactive proof systems,[51] (like zero-knowledge proofs),[52] systems for secret sharing,[53][54] etc.

Lightweight cryptography

Lightweight cryptography (LWC) concerns cryptographic algorithms developed for a strictly constrained environment. The growth of Internet of Things (IoT) has spiked research into the development of lightweight algorithms that are better suited for the environment. An IoT environment requires strict constraints on power consumption, processing power, and security.[55] Algorithms such as PRESENT, AES, and SPECK are examples of the many LWC algorithms that have been developed to achieve the standard set by the National Institute of Standards and Technology.[56]

Applications

In general

To ensure secrecy during transmission, many systems use private key cryptography to protect transmitted information. With public-key systems, one can maintain secrecy without a master key or a large number of keys

In cybersecurity

Cryptography can be used to secure communications by encrypting them. Websites use encryption via HTTPS.[58] "End-to-end" encryption, where only sender and receiver can read messages, is implemented for email in Pretty Good Privacy and for secure messaging in general in Signal and WhatsApp.[58]

Operating systems use encryption to keep passwords secret, conceal parts of the system, and ensure that software updates are truly from the system maker.[58] Instead of storing plaintext passwords, computer systems store hashes thereof; then, when a user logs in, the system passes the given password through a cryptographic hash function and compares it to the hashed value on file. In this manner, neither the system nor an attacker has at any point access to the password in plaintext.[58]

Encryption is sometimes used to encrypt one's entire drive. For example, University College London has implemented BitLocker (a program by Microsoft) to render drive data opaque without users logging in.[58]

Legal issues

Prohibitions

Cryptography has long been of interest to intelligence gathering and law enforcement agencies.[8] Secret communications may be criminal or even treasonous[citation needed]. Because of its facilitation of privacy, and the diminution of privacy attendant on its prohibition, cryptography is also of considerable interest to civil rights supporters. Accordingly, there has been a history of controversial legal issues surrounding cryptography, especially since the advent of inexpensive computers has made widespread access to high-quality cryptography possible.

In some countries, even the domestic use of cryptography is, or has been, restricted. Until 1999, France significantly restricted the use of cryptography domestically, though it has since relaxed many of these rules. In China and Iran, a license is still required to use cryptography.[6] Many countries have tight restrictions on the use of cryptography. Among the more restrictive are laws in Belarus, Kazakhstan, Mongolia, Pakistan, Singapore, Tunisia, and Vietnam.[59]

In the United States, cryptography is legal for domestic use, but there has been much conflict over legal issues related to cryptography.[8] One particularly important issue has been the export of cryptography and cryptographic software and hardware. Probably because of the importance of cryptanalysis in World War II and an expectation that cryptography would continue to be important for national security, many Western governments have, at some point, strictly regulated export of cryptography. After World War II, it was illegal in the US to sell or distribute encryption technology overseas; in fact, encryption was designated as auxiliary military equipment and put on the United States Munitions List.[60] Until the development of the personal computer, asymmetric key algorithms (i.e., public key techniques), and the Internet, this was not especially problematic. However, as the Internet grew and computers became more widely available, high-quality encryption techniques became well known around the globe.

Export controls

In the 1990s, there were several challenges to US export regulation of cryptography. After the source code for Philip Zimmermann's Pretty Good Privacy (PGP) encryption program found its way onto the Internet in June 1991, a complaint by RSA Security (then called RSA Data Security, Inc.) resulted in a lengthy criminal investigation of Zimmermann by the US Customs Service and the FBI, though no charges were ever filed.[61][62] Daniel J. Bernstein, then a graduate student at UC Berkeley, brought a lawsuit against the US government challenging some aspects of the restrictions based on free speech grounds. The 1995 case Bernstein v. United States ultimately resulted in a 1999 decision that printed source code for cryptographic algorithms and systems was protected as free speech by the United States Constitution.[63]

In 1996, thirty-nine countries signed the Wassenaar Arrangement, an arms control treaty that deals with the export of arms and "dual-use" technologies such as cryptography. The treaty stipulated that the use of cryptography with short key-lengths (56-bit for symmetric encryption, 512-bit for RSA) would no longer be export-controlled.[64] Cryptography exports from the US became less strictly regulated as a consequence of a major relaxation in 2000;[65] there are no longer very many restrictions on key sizes in US-exported mass-market software. Since this relaxation in US export restrictions, and because most personal computers connected to the Internet include US-sourced web browsers such as Firefox or Internet Explorer, almost every Internet user worldwide has potential access to quality cryptography via their browsers (e.g., via Transport Layer Security). The Mozilla Thunderbird and Microsoft Outlook E-mail client programs similarly can transmit and receive emails via TLS, and can send and receive email encrypted with S/MIME. Many Internet users don't realize that their basic application software contains such extensive cryptosystems. These browsers and email programs are so ubiquitous that even governments whose intent is to regulate civilian use of cryptography generally don't find it practical to do much to control distribution or use of cryptography of this quality, so even when such laws are in force, actual enforcement is often effectively impossible.[citation needed]

NSA involvement

Another contentious issue connected to cryptography in the United States is the influence of the National Security Agency on cipher development and policy.[8] The NSA was involved with the design of DES during its development at IBM and its consideration by the National Bureau of Standards as a possible Federal Standard for cryptography.[66] DES was designed to be resistant to differential cryptanalysis,[67] a powerful and general cryptanalytic technique known to the NSA and IBM, that became publicly known only when it was rediscovered in the late 1980s.[68] According to Steven Levy, IBM discovered differential cryptanalysis,[62] but kept the technique secret at the NSA's request. The technique became publicly known only when Biham and Shamir re-discovered and announced it some years later. The entire affair illustrates the difficulty of determining what resources and knowledge an attacker might actually have.

Another instance of the NSA's involvement was the 1993 Clipper chip affair, an encryption microchip intended to be part of the Capstone cryptography-control initiative. Clipper was widely criticized by cryptographers for two reasons. The cipher algorithm (called Skipjack) was then classified (declassified in 1998, long after the Clipper initiative lapsed). The classified cipher caused concerns that the NSA had deliberately made the cipher weak in order to assist its intelligence efforts. The whole initiative was also criticized based on its violation of Kerckhoffs's Principle, as the scheme included a special escrow key held by the government for use by law enforcement (i.e. wiretapping).

Digital rights management

Cryptography is central to digital rights management (DRM), a group of techniques for technologically controlling use of copyrighted material, being widely implemented and deployed at the behest of some copyright holders. In 1998, U.S. President Bill Clinton signed the Digital Millennium Copyright Act (DMCA), which criminalized all production, dissemination, and use of certain cryptanalytic techniques and technology (now known or later discovered); specifically, those that could be used to circumvent DRM technological schemes.[69] This had a noticeable impact on the cryptography research community since an argument can be made that any cryptanalytic research violated the DMCA. Similar statutes have since been enacted in several countries and regions, including the implementation in the EU Copyright Directive. Similar restrictions are called for by treaties signed by World Intellectual Property Organization member-states.

The United States Department of Justice and FBI have not enforced the DMCA as rigorously as had been feared by some, but the law, nonetheless, remains a controversial one. Niels Ferguson, a well-respected cryptography researcher, has publicly stated that he will not release some of his research into an Intel security design for fear of prosecution under the DMCA.[70] Cryptologist Bruce Schneier has argued that the DMCA encourages vendor lock-in, while inhibiting actual measures toward cyber-security.[71] Both Alan Cox (longtime Linux kernel developer) and Edward Felten (and some of his students at Princeton) have encountered problems related to the Act. Dmitry Sklyarov was arrested during a visit to the US from Russia, and jailed for five months pending trial for alleged violations of the DMCA arising from work he had done in Russia, where the work was legal. In 2007, the cryptographic keys responsible for Blu-ray and HD DVD content scrambling were discovered and released onto the Internet. In both cases, the Motion Picture Association of America sent out numerous DMCA takedown notices, and there was a massive Internet backlash[9] triggered by the perceived impact of such notices on fair use and free speech.

Forced disclosure of encryption keys

In the United Kingdom, the Regulation of Investigatory Powers Act gives UK police the powers to force suspects to decrypt files or hand over passwords that protect encryption keys. Failure to comply is an offense in its own right, punishable on conviction by a two-year jail sentence or up to five years in cases involving national security.[7] Successful prosecutions have occurred under the Act; the first, in 2009,[72] resulted in a term of 13 months' imprisonment.[73] Similar forced disclosure laws in Australia, Finland, France, and India compel individual suspects under investigation to hand over encryption keys or passwords during a criminal investigation.

In the United States, the federal criminal case of United States v. Fricosu addressed whether a search warrant can compel a person to reveal an encryption passphrase or password.[74] The Electronic Frontier Foundation (EFF) argued that this is a violation of the protection from self-incrimination given by the Fifth Amendment.[75] In 2012, the court ruled that under the All Writs Act, the defendant was required to produce an unencrypted hard drive for the court.[76]

In many jurisdictions, the legal status of forced disclosure remains unclear.

The 2016 FBI–Apple encryption dispute concerns the ability of courts in the United States to compel manufacturers' assistance in unlocking cell phones whose contents are cryptographically protected.

As a potential counter-measure to forced disclosure some cryptographic software supports plausible deniability, where the encrypted data is indistinguishable from unused random data (for example such as that of a drive which has been securely wiped).

Smart contract

A smart contract is a computer program or a transaction protocol which is intended to automatically execute, control or document legally relevant events and actions according to the terms of a contract or an agreement. The objectives of smart contracts are the reduction of need in trusted intermediators, arbitrations and enforcement costs, fraud losses, as well as the reduction of malicious and accidental exceptions.

Vending machines are mentioned as the oldest piece of technology equivalent to smart contract implementation.2014's white paper about the cryptocurrency Ethereum describes the Bitcoin protocol as a weak version of the smart contract concept as defined by computer scientist, lawyer and cryptographer Nick Szabo. Since Bitcoin, various cryptocurrencies support scripting languages which allow for more advanced smart contracts between untrusted parties. Smart contracts should be distinguished from smart legal contracts. The latter refers to a traditional natural language legally-binding agreement which has certain terms expressed and implemented in machine-readable code.

Etymology

Smart contracts were first proposed in the early 1990s by Nick Szabo, who coined the term, using it to refer to "a set of promises, specified in digital form, including protocols within which the parties perform on these promises".[11][12] In 1998, the term was used to describe objects in rights management service layer of the system The Stanford Infobus, which was a part of Stanford Digital Library Project.

Legal status of smart contracts

A smart contract does not necessarily constitute a valid binding agreement at law.[13] Some legal academics claim that smart contracts are not legal agreements, but rather means of performing obligations deriving from other agreements[14] such as technological means for the automation of payment obligations[15] or obligations consisting in the transfer of tokens or cryptocurrencies. Additionally, other scholars have argued that the imperative or declarative nature of programming languages can impact the legal validity of smart contracts.

Since the 2015 launch of the Ethereum blockchain,[17] the term "smart contract" has been more specifically applied toward the notion of general purpose computation that takes place on a blockchain or distributed ledger. The US National Institute of Standards and Technology describes a "smart contract" as a "collection of code and data (sometimes referred to as functions and state) that is deployed using cryptographically signed transactions on the blockchain network".[18] In this interpretation, used for example by the Ethereum Foundation[6] or IBM,[19] a smart contract is not necessarily related to the classical concept of a contract, but can be any kind of computer program. A smart contract also can be regarded as a secured stored procedure as its execution and codified effects like the transfer of some value between parties are strictly enforced and can not be manipulated, after a transaction with specific contract details is stored into a blockchain or distributed ledger. That's because the actual execution of contracts is controlled and audited by the platform, not by any arbitrary server-side programs connecting to the platform.

In 2017, by implementing the Decree on Development of Digital Economy, Belarus has become the first-ever country to legalize smart contracts. Belarusian lawyer Denis Aleinikov is considered to be the author of a smart contract legal concept introduced by the decree.

In 2018, a US Senate report said: "While smart contracts might sound new, the concept is rooted in basic contract law. Usually, the judicial system adjudicates contractual disputes and enforces terms, but it is also common to have another arbitration method, especially for international transactions. With smart contracts, a program enforces the contract built into the code."[23] A number of states in the US have passed legislation on the use of smart contracts, such as Arizona,[24] Nevada,[25] Tennessee,[26] and Wyoming.[citation needed][27] And in April 2020, Iowa's House of Representatives passed a bill legally recognizing smart contacts in the state.

In April 2021, the UK Jurisdiction Taskforce (UKJT) published the Digital Dispute Resolution Rules (the Digital DR Rules) to help enable the rapid resolution of blockchain and crypto legal disputes in Britain.

Workings

Similar to a transfer of value on a blockchain, deployment of a smart contract on a blockchain occurs by sending a transaction from a wallet for the blockchain.[30] The transaction includes the compiled code for the smart contract as well as a special receiver address.[30] That transaction must then be included in a block that is added to the blockchain, at which point the smart contract's code will execute to establish the initial state of the smart contract.[30] Byzantine fault-tolerant algorithms secure the smart contract in a decentralized way from attempts to tamper with it. Once a smart contract is deployed, it cannot be updated.[31] Smart contracts on a blockchain can store arbitrary state and execute arbitrary computations. End clients interact with a smart contract through transactions. Such transactions with a smart contract can invoke other smart contracts. These transactions might result in changing the state and sending coins from one smart contract to another or from one account to another.[31]

The most popular blockchain for running smart contracts is Ethereum.[32] On Ethereum, smart contracts are typically written in a Turing-complete programming language called Solidity,[33] and compiled into low-level bytecode to be executed by the Ethereum Virtual Machine.[34] Due to the halting problem and other security problems, Turing-completeness is considered to be a risk and is deliberately avoided by languages like Vyper.[35][36] Some of the other smart contract programming languages missing Turing-completeness are Simplicity, Scilla, Ivy and Bitcoin Script.[36] However, measurements using regular expressions showed that only 35.3% of 53,757 Ethereum smart contracts included recursions and loops — constructs connected to the halting problem.[37]

Several languages are designed to enable formal verification: Bamboo, IELE, Simplicity, Michelson (can be verified with Coq),[36] Liquidity (compiles to Michelson), Scilla, DAML and Pact.[35]

Processes on a blockchain are generally deterministic in order to ensure Byzantine fault-tolerance.[40] Nevertheless, real world application of smart contracts, such as lotteries and casinos, require secure randomness.[41] In fact, blockchain technology reduces the costs for conducting of a lottery and is therefore beneficial for the participants. Randomness on blockchain can be implemented by using block hashes or timestamps, oracles, commitment schemes, special smart contracts like RANDAO[42][43] and Quanta as well as sequences from mixed strategy Nash equilibria.[40]

Applications

In 1998, Szabo proposed that smart contract infrastructure can be implemented by replicated asset registries and contract execution using cryptographic hash chains and Byzantine fault-tolerant replication.[44] Askemos implemented this approach in 2002[45][46] using Scheme (later adding SQLite[47][48]) as contract script language.

One proposal for using bitcoin for replicated asset registration and contract execution is called "colored coins".[50] Replicated titles for potentially arbitrary forms of property, along with replicated contract execution, are implemented in different projects.

As of 2015, UBS was experimenting with "smart bonds" that use the bitcoin blockchain[51] in which payment streams could hypothetically be fully automated, creating a self-paying instrument.

Inheritance wishes could hypothetically be implemented automatically upon registration of a death certificate by means of smart contracts.[53][54] Birth certificates can also work together with smart contracts.

Smart contracts can also be used to handle real estate transactions [57] (i.e. via Propy, ...)[58] [59] and blockchain solutions are also proliferating on the field of title records and in the public register.

Smart contracts can also be used in employment contracts, especially temporary employment contracts, offering benefits for both employer and employee.

Security issues

A blockchain-based smart contract is visible to all users of said blockchain. However, this leads to a situation where bugs, including security holes, are visible to all yet may not be quickly fixed.[67] Such an attack, difficult to fix quickly, was successfully executed on The DAO in June 2016, draining approximately US$50 million worth of Ether at the time, while developers attempted to come to a solution that would gain consensus.[68] The DAO program had a time delay in place before the hacker could remove the funds; a hard fork of the Ethereum software was done to claw back the funds from the attacker before the time limit expired.[69] Other high-profile attacks include the Parity multisignature wallet attacks, and an integer underflow/overflow attack (2018), totaling over US$184 million.

Issues in Ethereum smart contracts, in particular, include ambiguities and easy-but-insecure constructs in its contract language Solidity, compiler bugs, Ethereum Virtual Machine bugs, attacks on the blockchain network, the immutability of bugs and that there is no central source documenting known vulnerabilities, attacks and problematic constructs.[39]

Difference from smart legal contracts

Smart legal contracts are distinct from smart contracts. As mentioned above, a smart contract is not necessarily legally enforceable as a contract. On the other hand, a smart legal contract has all the elements of a legally enforceable contract in the jurisdiction in which it can be enforced and it can be enforced by a court or tribunal. Therefore, while every smart legal contract will contain some elements of a smart contract, not every smart contract will be a smart legal contract.

There is no formal definition of a smart legal contract in the legal industry.

A Ricardian contract is a type of smart legal contract.

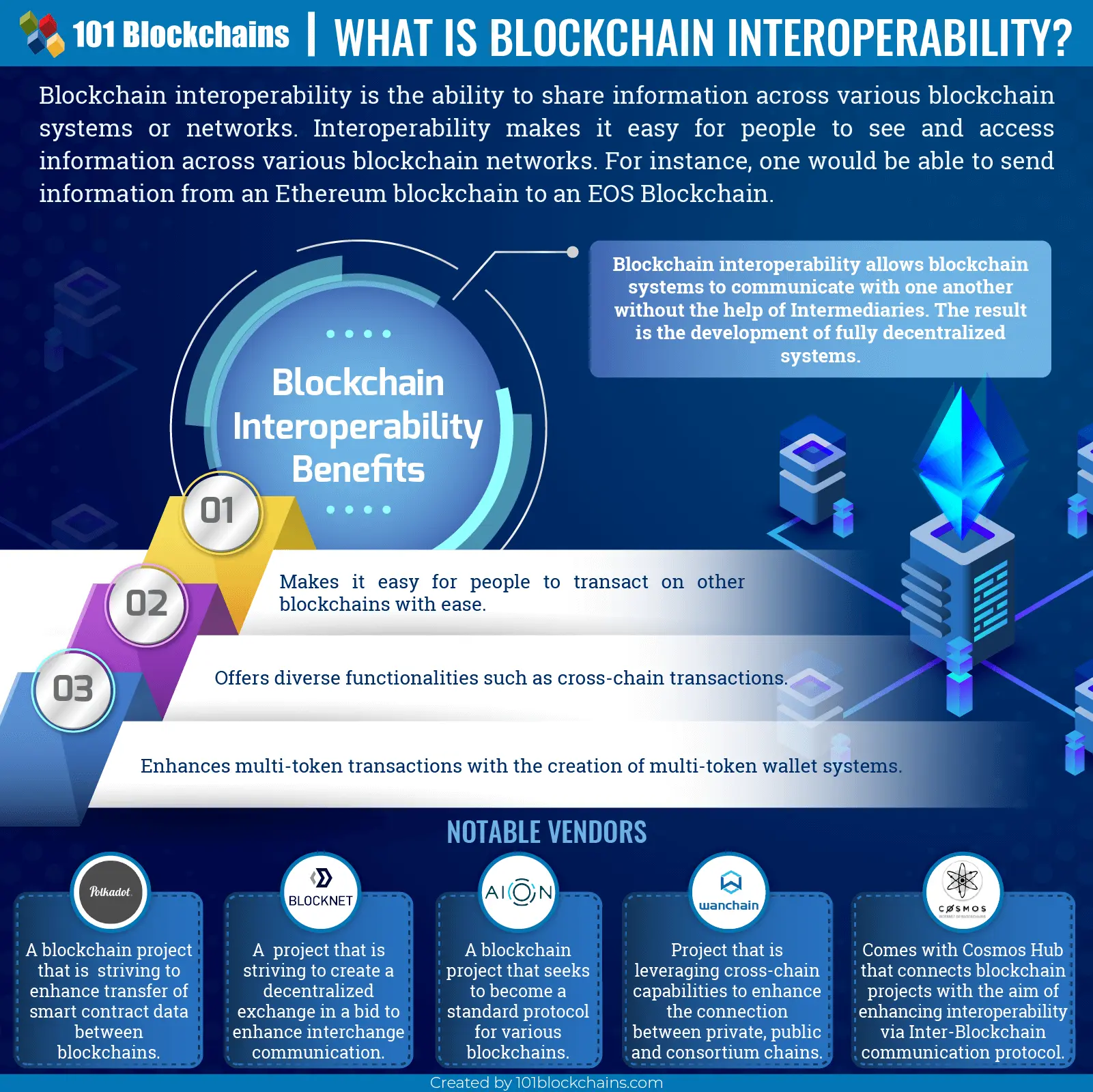

Blockchain Interoperability : Why Is Cross Chain Technology Important?

Blockchain and distributed ledger networks are exploding by the day. Interconnecting these new chains is becoming a necessity as more people continue to take note of the emerging technology and its capabilities. Let’s dive in deeper to see what is blockchain interoperability and why does it matter so much.

The number of blockchain projects is on the rise in part because developers are thinking outside the box as they try to leverage the technology’s capabilities. The increase also comes on acknowledgment that no perfect solution will be able to address all blockchain needs at once.

A perfect example is the IOTA blockchain that seeks to enhance payments on the Internet of Things. VeChain, on the other hand, shares similar capabilities but with the aim of strengthening supply chain management on the blockchain. Stellar blockchain, on the other hand, seeks to make it easy for people to come up with a global payment network for solving low latency issues in remote areas.

Amidst the proliferation of blockchain projects, one thing stands out. All blockchains as well as ledgers and DAGs perform a different set of transactions and handle different amounts of data processing. It is also becoming increasingly clear that there are different networks and blockchains designed for specific labor unions, religions, community organizations as well as government departments.

The rapid development of blockchain is set to give rise to many different kinds of chains. One such technology that is becoming increasingly evident is Cross Chain Technology.

Blockchain Interoperability: What is Cross Chain Technology?

Cross Chain, technology is increasingly becoming a hot topic of discussion seen as the ultimate solution for enhancing interoperability between blockchains. In Layman terms, a Cross-chain Technology is an emerging technology that seeks to allow transmission of value and information between different blockchain networks.

Increased usage of established networks like Ripple, Bitcoin, and Ethereum while a good thing has given rise to many issues key among them being economical and technical scaling limitations. As discussed above most blockchain networks operate on isolated ecosystems as they address they try to resolve a unique set of needs.

The fact that the chains operate in isolation has mostly made it impossible for people to enjoy the full benefits the ledger technology. The inability of different blockchains to communicate with one another has made it impossible for people to enjoy the full benefits of blockchain technology. Cross chain, technology seeks to solve all these issues, by enabling interoperability between blockchains thus making it easy for them to communicate with one another and share information.

Cross Blockchain Compatibility

Cross-chain, protocol ensures interoperability between blockchains, thus enabling the exchange of value as well as information between various networks. Complimented with the benefits of public decentralized chains, such protocols should lay the foundation for blockchain mass adoption and use

Cross blockchain compatibility, allows different blockchains to communicate with one another without the help of intermediaries. What this means is that blockchains sharing similar networks will be able to transfer value between each other.

While in use in a business ecosystem, businesses will no longer have to contend only with clients on a network the business as built on. Instead, companies will be able to transact with clients from other compatible blockchains. The entire process will take place without any downtime or expensive transaction fees. Just as is the case with the Internet of value, cross blockchain compatibility will accord blockchain networks an effective means of value transmission.

Who Is Leveraging Cross-Chain Technology?

Ripple is an excellent example of a blockchain project trying to explore cross chain transactions. While it is still in the early days of development, Ripple is trying to make it possible for people and entities to exchange various digital assets across different blockchains.

For starters, Ripple has already started helping banks, around the world, settle cross-border payments with one another across different currencies and cryptocurrencies. However, the blockchain project faces an uphill task to polish its cross-chain technology.

Importance of Blockchain Interoperability

The success of blockchain technology will come down to how different blockchain networks can interact and integrate. For that reason, interoperability between blockchains is the concept by which different blockchains communicate with one another all in the effort of enabling smooth sharing of information.

Interoperability is essentially the ability to see and access information across various blockchain systems. For example, should a person send data to another blockchain, the recipient should be able to read it, comprehend and react with little effort? However, that is not possible, at the moment, as it is impossible to share information between says Bitcoin and Ethereum blockchains.

Cross Chain, technology seeks to solve all this by enhancing interoperability between blockchains. Emerging projects are slowly buying the idea as they attempt to come up with platforms that can communicate with one another without the need of a third party.

Blockchain interoperability should go a long way in getting rid of intermediaries or third parties, synonymous with centralized systems. The ability of different decentralized networks to communicate with one another without any intermediaries should thus go a long way in giving rise to fully decentralized systems.

Why Though?

Interoperability of blockchains is of great importance, as it will go a long way in making it easy for people to transact on other blockchains seamless. Currently one can only transact on one blockchain at a go i.e. Bitcoin or Ethereum. However, transferring information between two different chains is not possible.

Diverse Functionalities should come into being because of interoperability of blockchains. For starters, people will be able to make payments across multiple blockchains. A fully perfect blockchain interoperability project should thus be the core of the digital economy in future.

Blockchain Interoperability should also lead to multi-token transactions thanks to the development of multi-token wallet systems. Such a development will allow users to rely on a single wallet system to for storage and transfer of tokens with ease across various blockchains.

Blockchain Interoperability Projects

Given the ever-growing need to enhance the connection between various blockchain networks, many developers are already working on optimal solutions. The number of blockchain interoperability projects is on the rise as a result as developers look to accelerate blockchain mass adoption. Below are some of the top projects, looking to enhance blockchain interoperability.

Polkadot blockchain

Polkadot blockchain is a high-profile multi-chain technology taking blockchain interoperability to another level. A brainchild of Gavid Wood, one of the founders of Ethereum, Polkadot seeks to enhance the transfer of smart contract data through various blockchains.

Polkadot consists of multiple parachains that differ in characteristics. In Polkadot blockchain, transactions can be spread over a wide area given the number of chains in the network. All this is done while ensuring high levels of security on dealings.

Polkadot Blockchain interoperability project seeks to ensure a seamless connection between private chains, public networks, oracles as well as permission less interface. The developers behind the blockchain interoperability solutions want to enable an internet where independent blockchain solutions will be able to exchange information via a Polkadot relay chain.

The fundamental tenets of the blockchain interoperability solutions are scalability as well as governance.

Blocknet

Developers behind Blocknet are currently working on creating a decentralized exchange all in the effort of enhancing interchange communication.

Blockchain is also implementing blockchain interoperability strategies that can change the way we see blockchain at the moment.

What Blocknet intends to do is decentralize all the four components all in the effort of creating the first Decentralized exchange. The project backers are also working on optimizing the cross-chain platform to serve as infrastructure.

Aion Online

Aion online is another high profile Blockchain interoperability project that seeks to address unresolved questions around scalability and interoperability in blockchain networks. Developers are planning to position Aion as the standard protocol used by various blockchains. The end game is to enhance the creation of efficient and decentralized systems.

The developers have already come up with a federated blockchain network that makes it possible to integrate disparate blockchain systems in multi-tier hub.

Wanchain

Wanchain casts itself as the world’s first online blockchain interoperable blockchain solution, with secure multi-party computing. More so, the blockchain interoperability solution seeks to rebuild finance by housing all digital assets on one blockchain.

They are introducing one of the unique blockchain interoperability strategies at the moment.